Sales and use tax computation

Ad Accurately file and remit the sales tax you collect in all jurisdictions. In the US and the District of Columbia all states except Alaska Delaware Montana New Hampshire and Oregon impose a state sales tax when you buy items or pay for services.

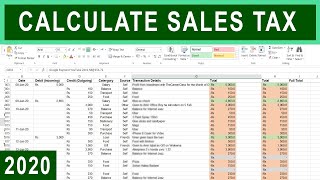

How To Calculate Sales Tax In Excel Tutorial Youtube

The third decimal place is four so the tax would be rounded to the nearest whole cent and would be 93.

. Streamlined Sales and Use Tax Project. Interest accrues from the due date until paid. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

The type of license plates requested. The Nebraska state sales and use tax rate is 55 055. The county the vehicle is registered in.

Special rates and situations An 115 percent tax is imposed on short-term passenger car and recreational vehicle rentals. More information about the calculations performed is available on the about page. Sales and use tax system product suite that offers sales tax policy configuration calculation remittance and filing.

Whether or not you have a trade-in. Ad Avalara Consumer Use Reconciles Transactions and Automates Your Use Tax Compliance. Retailers owe the occupation tax to the department.

2022 Current Resources- Sales Use Taxes. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. The general state tax rate is 7.

Sales tax is a tax on the sale of goods and services. Sales tax is a combination of occupation taxes that are imposed on retailers receipts and use taxes that are imposed on amounts paid by purchasers. The use tax is a back stop for sales tax and generally applies to property purchased outside the state for storage use or consumption within the state.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. If only the state sales or use tax of 6 applies divide the gross receipts by 106 as shown in the example below. Tax calculation 101 Calculations products Sales and use tax returns 101 Common challenges of managing returns Returns and reporting products.

What is Sales Tax. Beginning January 1 2023 the rate will decrease to 1. The forms are scannable forms for processing purposes.

Retail sales of new mobile homes - 3 Amusement machine receipts - 4 Rental lease or license of commercial real property - 55 Electricity - 695 Use Tax. They reimburse themselves for this liability by collecting use tax from the buyers. The term sales tax actually refers to several tax acts.

The state sales and use tax rate is 575 percent. What qualifies as food for home consumption. The state in which you live.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. This is your total annual salary before any deductions have been made. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act.

Download our sales and use tax rate chart. TaxCloud offers sales tax calculation for any address in the United States as well as registration filing remittance detailed reporting and audit response services. See where that hard-earned money goes - with Federal Income Tax Social Security and other deductions.

The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. New car sales tax OR used car sales tax. Ad Sales Use Taxes Same Day.

Most staple grocery items and cold prepared foods packaged for home. The sales tax is comprised of two parts a state portion and a local portion. Tax and Tags Calculator.

Certain short-term truck rentals are subject to an 8 percent tax. The Kentucky Sales Use Tax returns forms 51A102 51A102E 51A103 51A103E and 51A113 are not available online or by fax. Learn more about ONESOURCE Indirect Tax.

Avalara Consumer Use Offers A Smarter Easier Solution For Automating Use Tax. Tax rates are provided by Avalara and updated monthly. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Please click on the links to the left for more information about tax rates registration and filing. If a 1 local option tax applies divide by 107. Failure to file a return on time or pay the tax due may result in penalty and interest owed.

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. Look up 2022 sales tax rates for South Boston Virginia and surrounding areas. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer.

The tax calculation would be 09347. Floridas general state sales tax rate is 6 with the following exceptions. Note that the calculation is not to be rounded at the third decimal place which in this case would have resulted in a calculation of 0935 and a tax of 094.

Easily manage tax compliance for the most complex states product types and scenarios. Sales Tax Rate for Food and Personal Hygiene Products Sales of food for home consumption and certain essential personal hygiene products are taxed at the reduced rate of 25 throughout Virginia. Notice of New Sales Tax Requirements for Out-of-State Sellers.

Also effective October 1 2022 the following cities. Sale amount 1438 the tax rate 65. The local tax rate varies by county andor city.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800. Alaska however does allow localities to charge local sales taxes as do many other states.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

Brazilian Corporate Tax Real Bpc Partners

As Per The Changed Rules Notified Under Section 234f Of The Income Tax Act Which Came Into Effect From April 1 2017 Income Tax Filing Taxes Income Tax Return

Income Tax Computation Format Pdf Simple Guidance For You In Income Tax Computation Format P Tax Forms Income Tax Income

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

Advanced Money Word Problems Digital Cards Boom Learning Distance Learning Money Word Problems Word Problems Understanding Word Problems

How To Calculate Sales Tax In Excel

Excel Formula Two Tier Sales Tax Calculation Exceljet

How To Calculate Sales Tax In Excel

Small Business Tax Deductions Small Business Tax Business Tax Deductions

An Exclusive Solution For All Your Tax Filing Needs Features That Help You Make Tax Filing 100 Accurately Spect Filing Taxes Income Tax Return Tax Software

Effective Tax Rate Formula Calculator Excel Template

Money Task Cards Making Change Adding Tax Percent Of Sale Adding Tip Task Cards Money Task Cards Math Task Cards

How To Calculate California Sales Tax 11 Steps With Pictures

Excel Formula Income Tax Bracket Calculation Exceljet

Sales Tax Calculator

Spectrum Is Designed To Fully Automate The Process Of Tax Computation And Return Preparation Save A Lot More O Tax Software How To Apply Chartered Accountant

Taxable Income Formula Examples How To Calculate Taxable Income